Back

7 Aug 2019

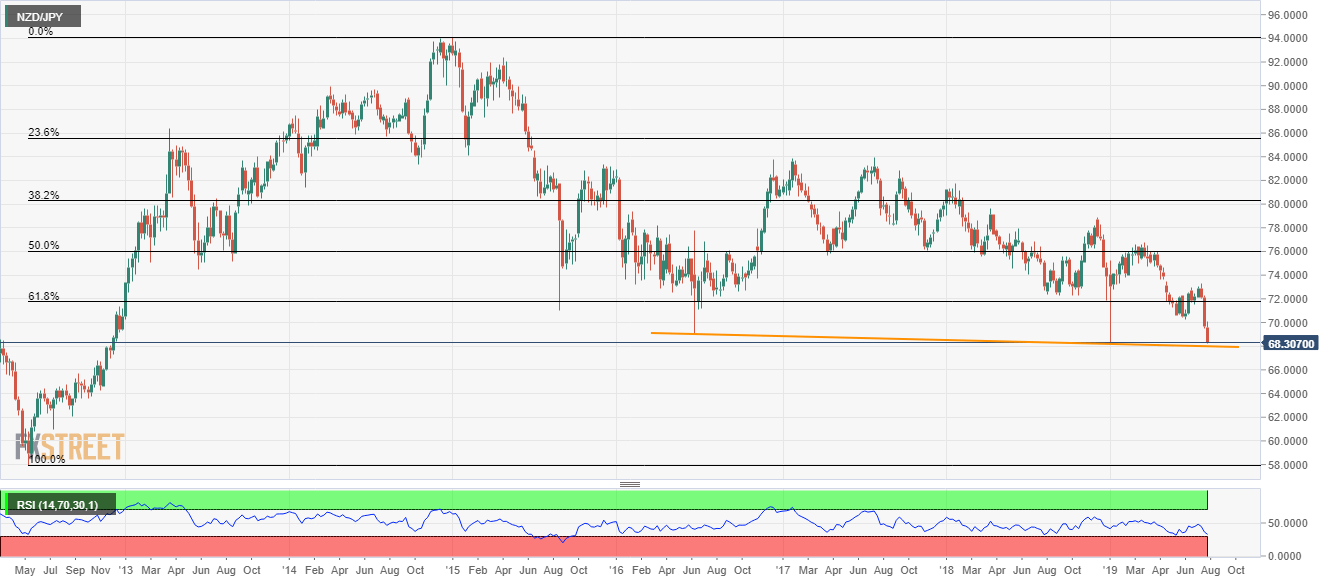

NZD/JPY technical analysis: Eyes on multi-month old support-line after RBNZ’s big rate cut

- NZD/JPY grinds lower towards January’s bottom after RBNZ announced higher than an expected rate cut.

- A downward sloping trend-line since June could offer strong support amid oversold RSI.

With the New Zealand Dollar (NZD) bears cheering the Reserve Bank of New Zealand’s (RBNZ) 0.5% rate cut, the NZD/JPY slumps to the lowest since January as it trades near 68.40 during Wednesday morning.

Even if January low near 68.20 can be considered as important support, a downward sloping trend-line since June 2016, at 68.00, could challenge the sellers amid oversold conditions of 14-bar relative strength index (RSI).

In a case where prices refrain to reverse from 68.00, its no harm expecting the return of November 2012 high near 66.78 to the chart.

On the upside, 70.00 may act as nearby resistance whereas buyers will look for a successful break beyond June month low around 70.27 to aim for 71.00 round-figure.

NZD/JPY weekly chart

Trend: Pullback expected