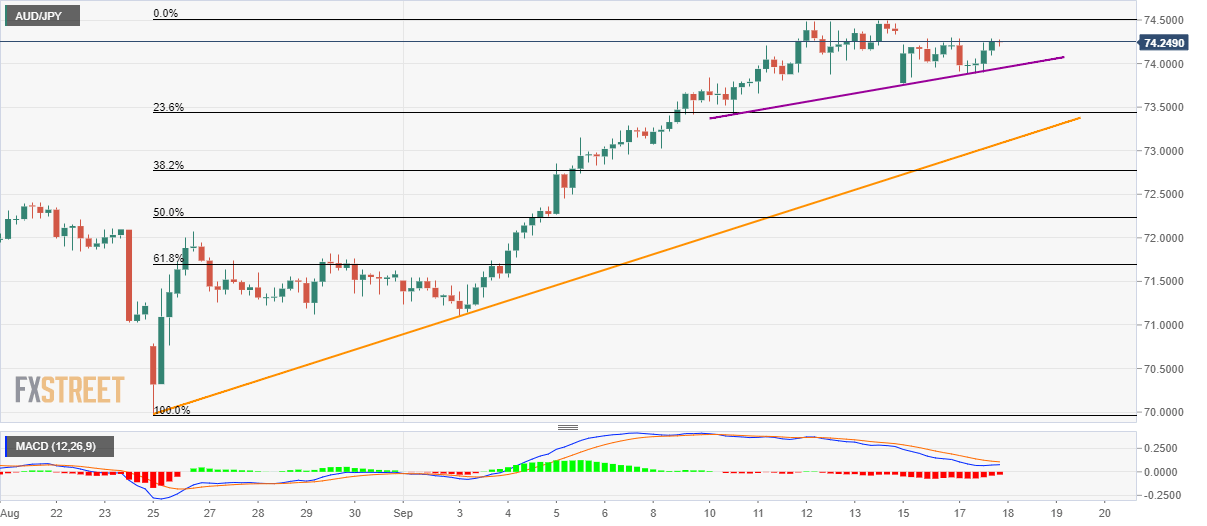

AUD/JPY technical analysis: Buyers lurk around 1-week-old support-line despite bearish MACD

- AUD/JPY takes the bids to recent range resistance following another bounce from immediate support-line.

- A rising trend-line from August 25 will gain sellers’ attention on the downside break of nearby support.

- 74.29/30 continues to restrict the pair’s upside since the week’s start.

AUD/JPY registers another bounce off one-week-old rising trend-line but still fails to overcome the weekly range while trading near 74.27 during the initial Asian session on Wednesday.

The quote needs to overcome 74.29/30 area in order to challenge the monthly top surrounding 74.50, a break of which holds the gate for additional upside towards 75.13/20 region comprising multiple highs and lows marked during July.

It should, however, be noted that 12-bar moving average convergence and divergence (MACD) indicates bearish signal and hence a downside break of immediate support-line, at 73.95 now, could trigger fresh declines.

In doing so, an upward sloping trend-line since August 25, at 73.08, becomes the key as a break of which can fetch the quote towards late-August highs surrounding 72.40.

AUD/JPY 4-hour chart

Trend: sideways